ai tools

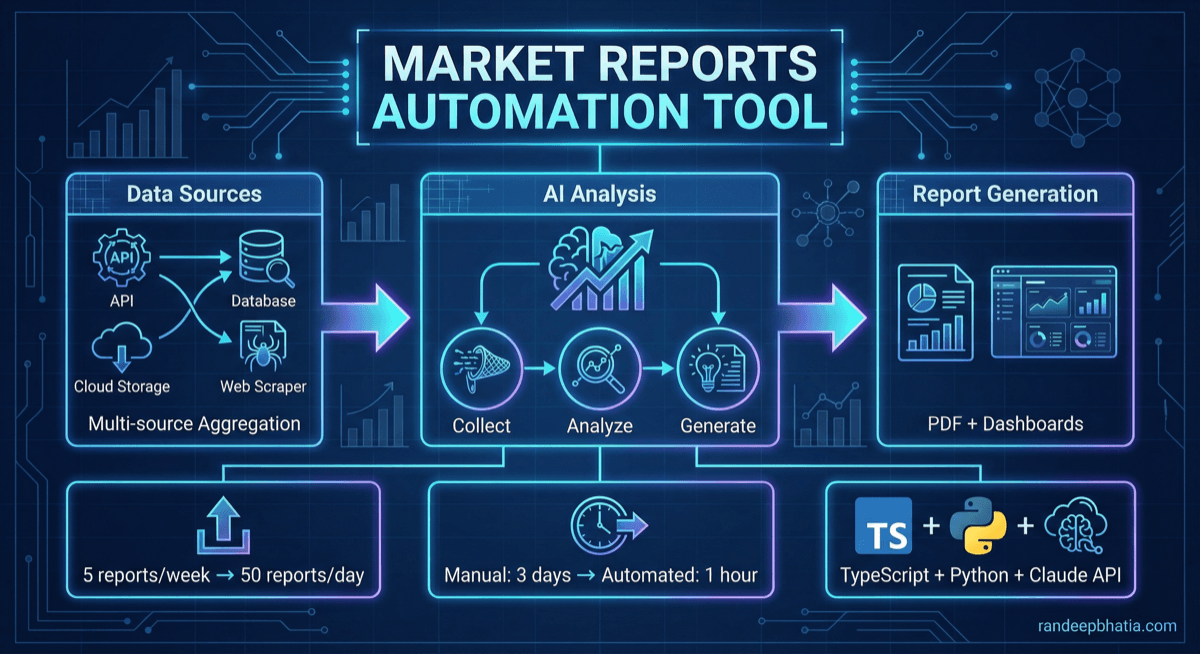

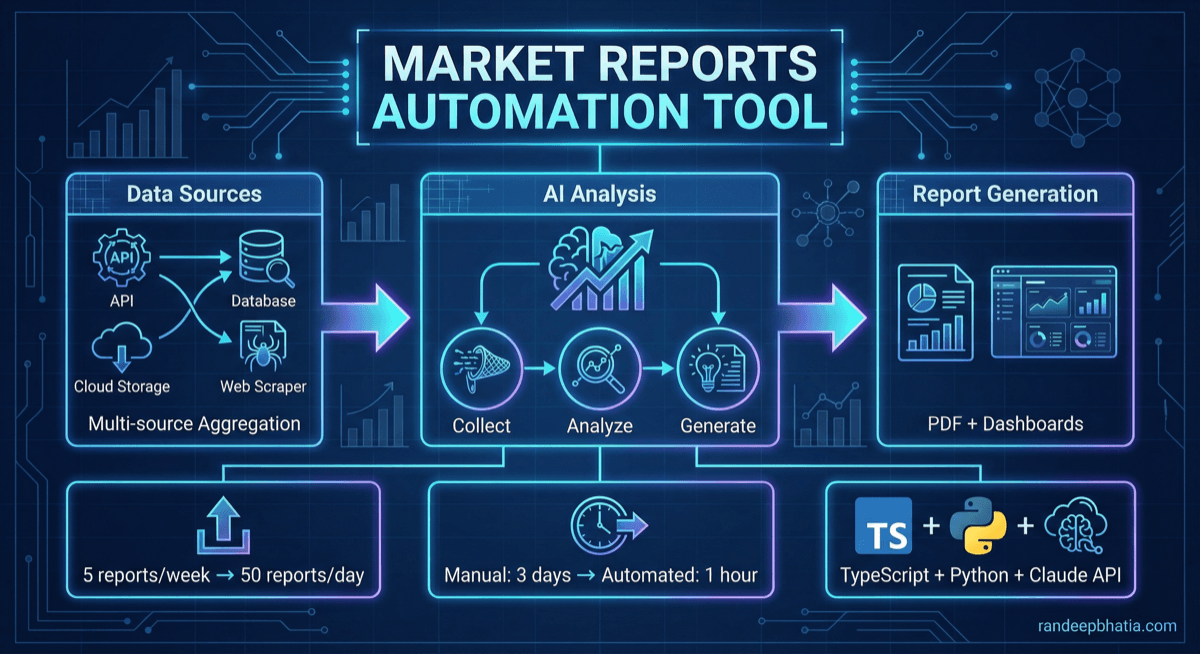

Market Reports Automation

Technical automation blueprint for market reports. Step-by-step guide for implementing AI-powered workflows.

2025-04-22

View Full Size

Technical automation blueprint for market reports. Step-by-step guide for implementing AI-powered workflows.

2025-04-22