ai tools

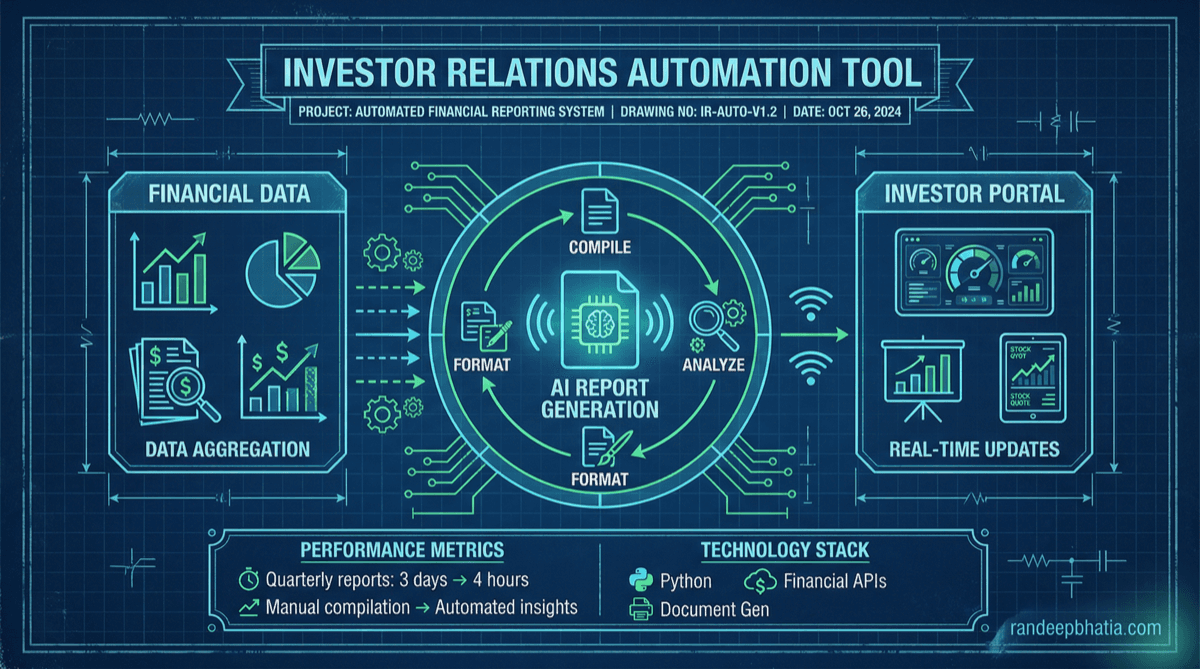

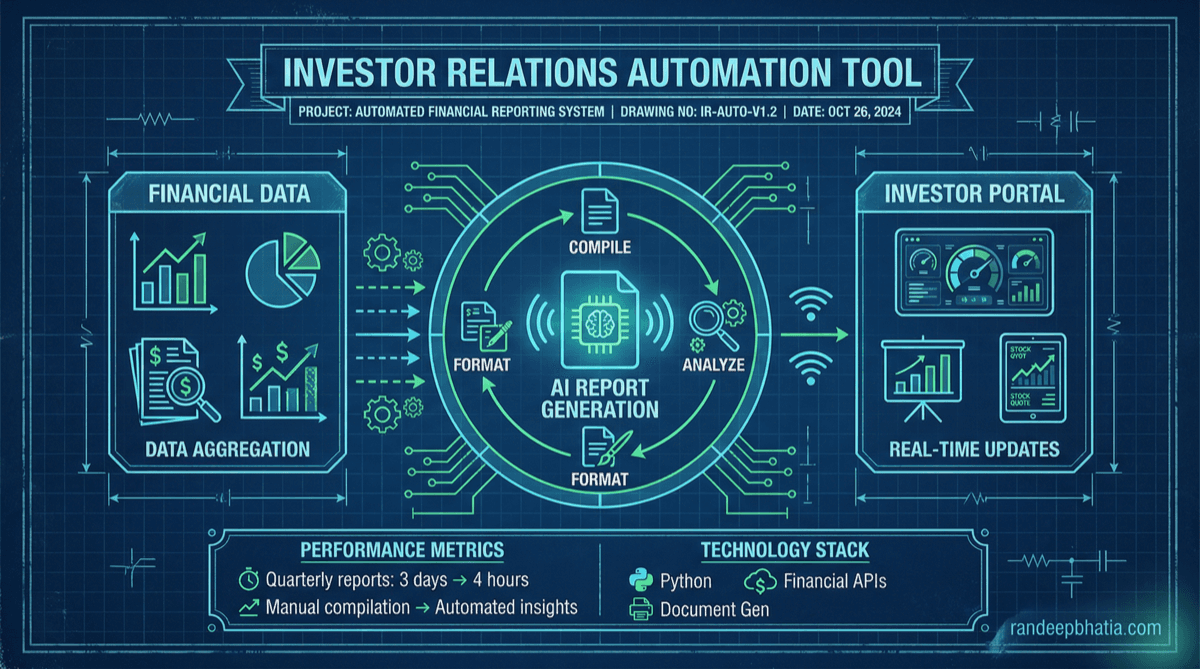

Investor Relations Automation

Technical automation blueprint for investor relations. Step-by-step guide for implementing AI-powered workflows.

2025-08-05

View Full Size

Technical automation blueprint for investor relations. Step-by-step guide for implementing AI-powered workflows.

2025-08-05