ai architecture

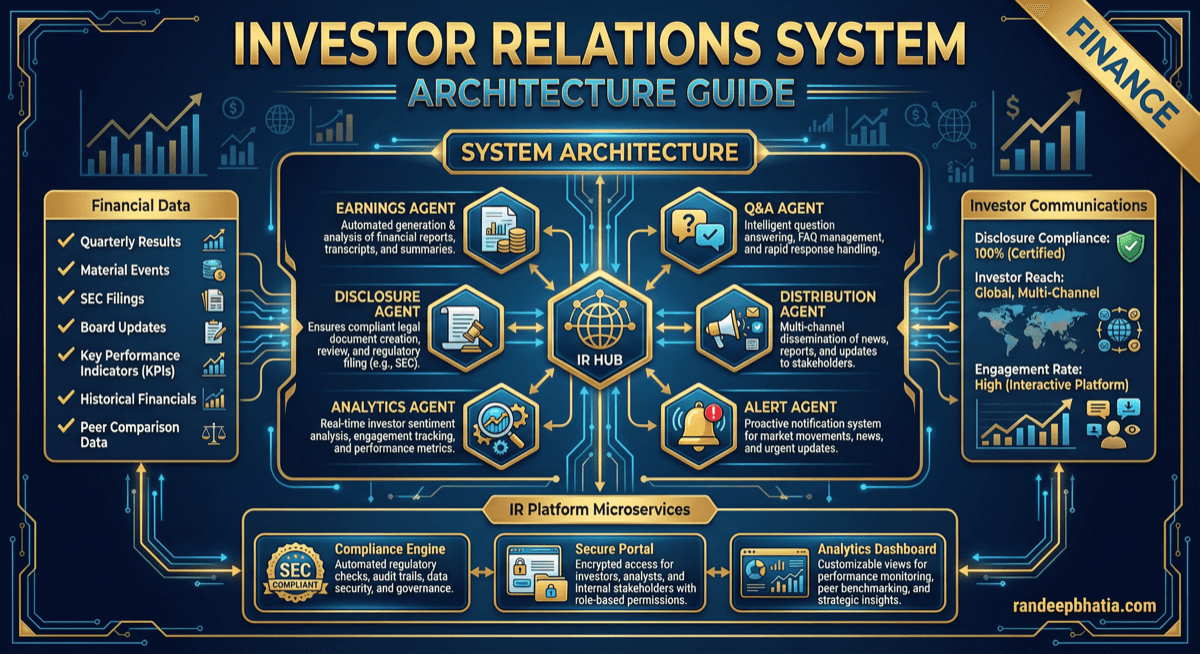

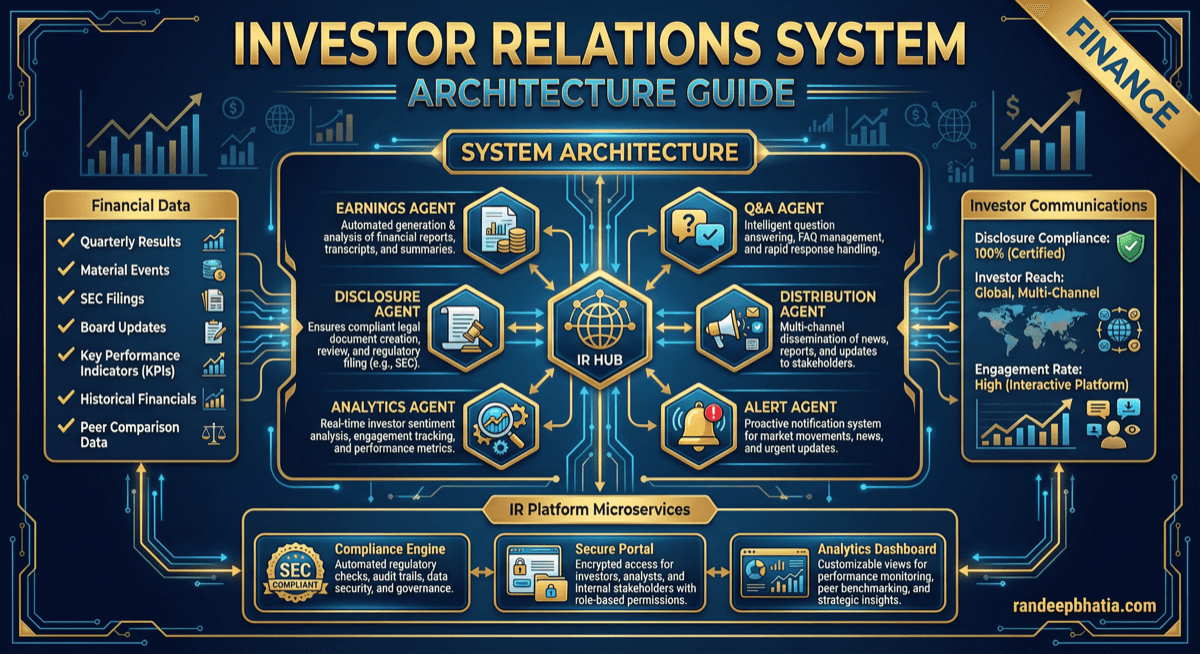

Investor Relations System Architecture

Production-ready system architecture for investor relations. Includes component design, data flow patterns, scaling strategies, and security considerations.

2025-08-07

View Full Size

Production-ready system architecture for investor relations. Includes component design, data flow patterns, scaling strategies, and security considerations.

2025-08-07